Definition:

Swing trading lies between the intensity of day trading and the patience of position trading. Trades are held from a few days to several weeks to capture “swings” within a trend.

Core Goal:

To profit from medium-term price movements caused by sentiment shifts, earnings announcements, or technical breakouts.

Pros:

- Balanced Approach: Less screen time than day trading but more engagement than long-term investing.

- Larger Profit Potential: Captures multi-day moves.

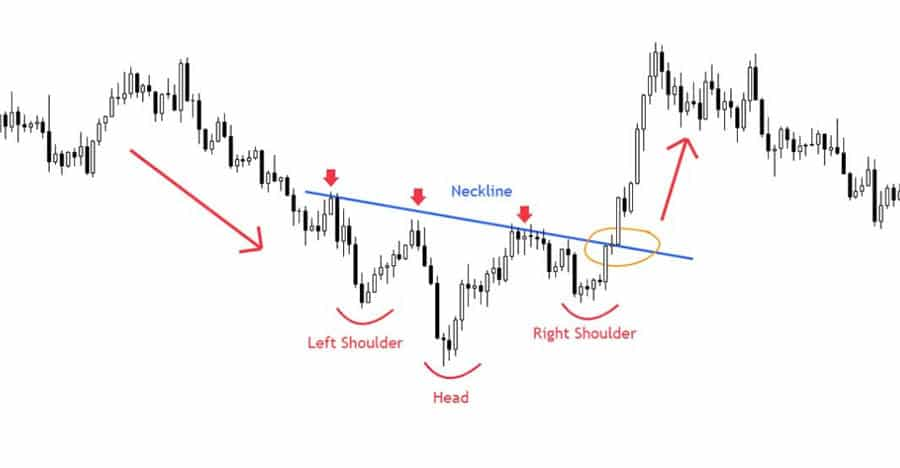

- Technical Focus: Works well with indicators like moving averages, RSI, and Fibonacci retracements.

Cons:

- Overnight Exposure: Market gaps can impact open trades.

- Patience Needed: Some trades take time to develop.

Best For:

Part-time traders who prefer flexibility and can hold positions through minor fluctuations.

👉 Example: A swing trader notices a bullish reversal pattern on gold and holds the trade for eight days, capturing a 4% price move before exiting near resistance.

Position Trading: The Long Game

Definition:

Position trading is the art of holding positions for weeks, months, or even years based on macroeconomic themes, sectoral trends, or company fundamentals.

Core Goal:

To achieve long-term wealth accumulation through patience and conviction.

Pros:

- Lower Stress: Less frequent trading means more time for research.

- Compounding Returns: Benefits from long-term growth and dividend reinvestment.

- Resilience: Can ride out short-term volatility.

Cons:

- Slow Gains: Immediate profits are rare.

- Capital Lock-Up: Funds remain invested for extended periods.

- Requires Conviction: High drawdowns may test patience.

Best For:

Investors who align their strategies with fundamental data and long-term market cycles.

👉 Example: A position trader accumulates renewable energy stocks, holding them through short-term market noise, anticipating multi-year growth from global decarbonization initiatives.

How to Choose the Right Trading Style

Selecting the right trading approach requires self-awareness and strategy alignment.

1. Risk Tolerance:

If you can manage fast losses and rapid gains, day trading may fit. Prefer slower, steadier progress? Swing or position trading might suit better.

2. Time Availability:

Full-time traders can focus on intraday charts; those with jobs or businesses might favor swing or position trades.

3. Capital Requirements:

Day traders need significant margin and liquidity, while long-term investors can start smaller and scale gradually.

4. Psychological Profile:

Day trading favors analytical minds and quick reflexes. Swing trading rewards flexibility, and position trading thrives on patience.

5. Test and Review:

Start small. Backtest strategies on demo accounts, record outcomes, and evaluate emotional performance before scaling up.

Bancara’s Support for Every Trading Style

Bancara empowers traders of every level to execute, analyze, and evolve their strategies seamlessly:

- For Day Traders: Low-latency execution ensures split-second order precision.

- For Swing Traders: Comprehensive analytics tools identify trend reversals and breakout points.

- For Position Traders: Fundamental data and macro insights support long-term decisions.

- For All: Access to equities, FX, commodities, and digital assets under one regulated multi-asset ecosystem.

Through platforms like BancaraX, MetaTrader 5, and AutoBancara, clients can blend automation with human control — achieving both speed and strategy.

Building a Hybrid Approach

Some traders combine methods — day trading volatile assets, swing trading mid-term trends, and holding long-term positions for wealth accumulation. This hybrid strategy maximizes opportunity while distributing risk across time horizons.

By leveraging Bancara’s technology and analytics, investors can maintain agility in fast markets while pursuing consistent growth over time — a balanced approach suited for 2025’s complex, interconnected markets.

Conclusion: Find Your Trading Identity

Every trading style offers a distinct path to success. Day trading rewards precision and focus, swing trading values patience and adaptability, while position trading honors conviction and vision. The best traders know themselves and build around their strengths.

With Bancara’s Global trading platform, traders gain the agility, insights, and tools to master any approach — combining execution speed with data-driven strategy.

Bancara – Southern Africa Regional Office, Bancara – Southeast Asia Office — explore the Bancara location.